Competition seems fierce, but what about growth potential?

Omnia LINK improves on a company-wide basis profit as external sales increase.

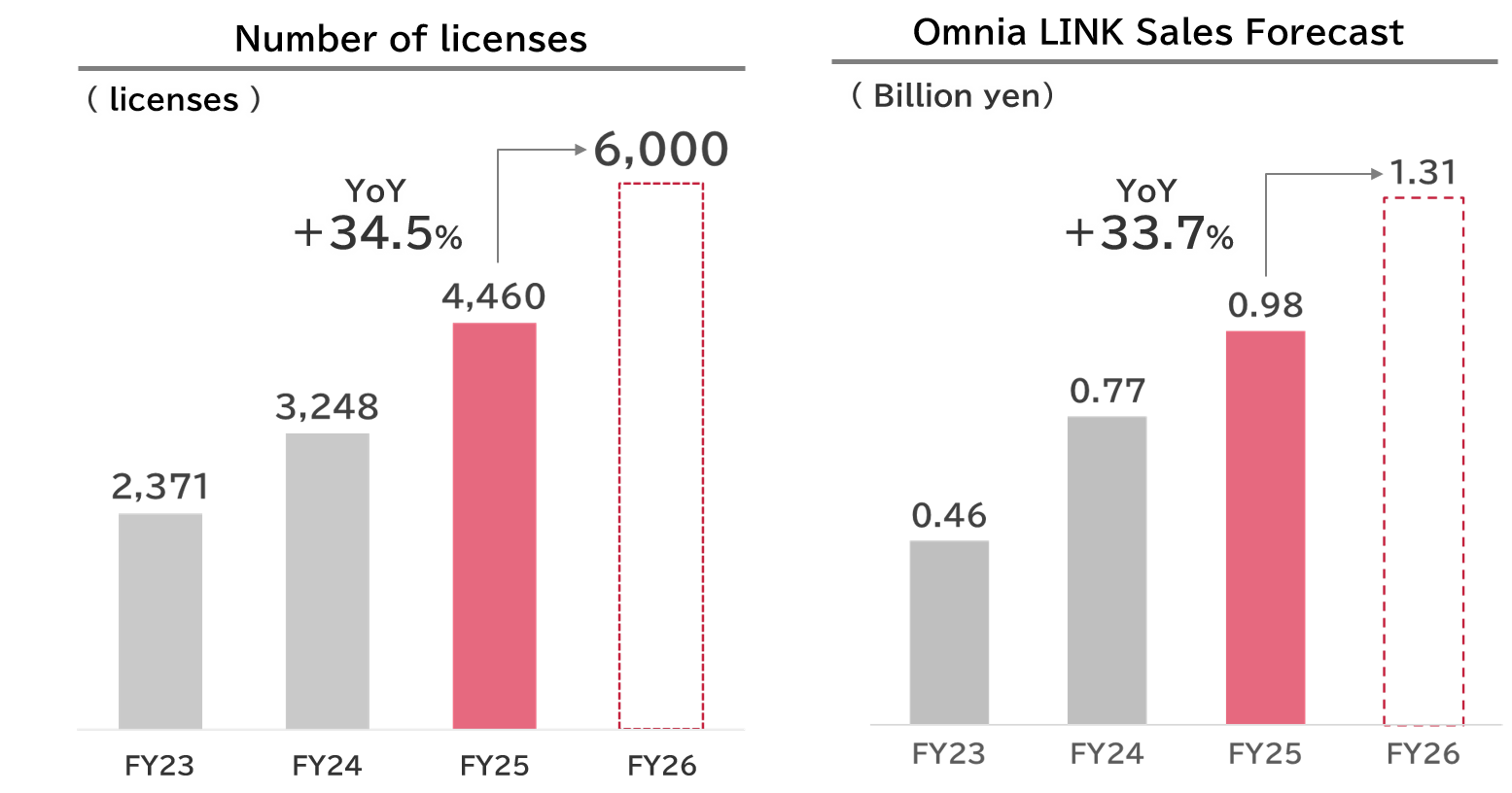

Omnia LINK is a cloud-based system that drives the profitability of the entire company. We are targeting 6,000 licenses and sales of 1.31 billion yen in the fiscal year ending May 2026. By increasing the external sales ratio of Omnia LINK, we aim to improve our profit margin.

Contact center/BPO has evolved by utilizing our systems.

Bewith increases the profitability of contact center/BPO by offering advanced service utilizing our systems, such as Omnia LINK.

Bewith provides clients with high-quality service through a combination of human-operation and systems.